- Investment Ideas

Curated selection of funds and plans for you

- Tools & Calculators

Wide range of tools to help you with your investments

- Register Mandate

For hassle free recurring investments

- Check NAV

Get the latest NAV of all schemes

- Starter Kit NEW INVESTOR?

Everything you need to plan your investment

- Get Statements

Get your statements mailed to your registered email ID

Explore our funds by...

-

Wealth Creation

Funds which offer Long Term Capital Appreciation

-

Retirement Planning

For Income Post Retirement

-

Tax Saving

Save Taxes Under Section 80 C

-

Liquidity Parking

Park your surplus funds

-

Balanced Funds

Manage market volatility effectively

Plan for your child

Invest for your child's better future

Quick Guides

At a Glance

Monthly Market

Outlook

Insights

Read about Mutual Funds to start investing and become a smart investor

Blogs

Blogs

Read insightful investment blogs to help you make informed financial decisions.

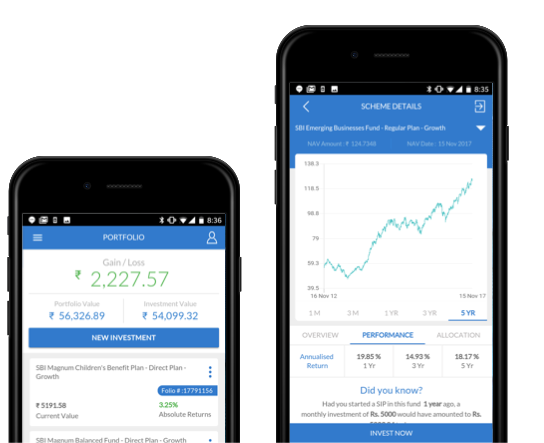

A solution for all your financial needs

Investment Packs (Coming Soon)

Pre-defined packs curated for you basis your risk appetite

Goal Planner (Coming Soon)

Have a Goal? Share the details and we’ll help you plan for it

Portfolio Builder (Coming Soon)

Create a personalized portfolio basis your risk appetite and targets

The penny wise podcast

Subscribe to the podcast channel so that you never miss out on anything.

Enter Name

Enter Email ID

Monthly Presentation on Economy & Markets - April 2024

Rajeev Radhakrishnan, CIO - Fixed Income, SBI MF

April, 2024

Any questions? Talk to us.

Give us a missed call on 1800 270 0060 and we’ll call you back. Or, chat with us on whatsapp.

Chat on WhatsappOur customers trust us with

₹3,82,00,00,000

33 Years

of performance

450K +

happy investors

100

cities across India

Loading...

.svg)